Sandicliffe: +182% traffic growth and leadership in emerging automotive brands in just 5 months

Sandicliffe is one of the leading automotive groups in the Midlands (UK), with a long-standing heritage dating back to 1948. From its head office in Stapleford (Nottingham), the company has built a network of specialist dealerships across Leicester, Loughborough, Nottingham and Lincoln.

https://www.sandicliffe.co.uk/

Facing the challenge of competing with major national retailers and building authority in a crowded market, Sandicliffe started from a stable organic baseline but with limited visibility beyond Google’s first pages for key terms.

+182% growth in total traffic

2.5x total impressions

The objective was clear: maximise the acquisition of qualified leads and boost e-commerce performance through a data-led content and optimisation strategy.

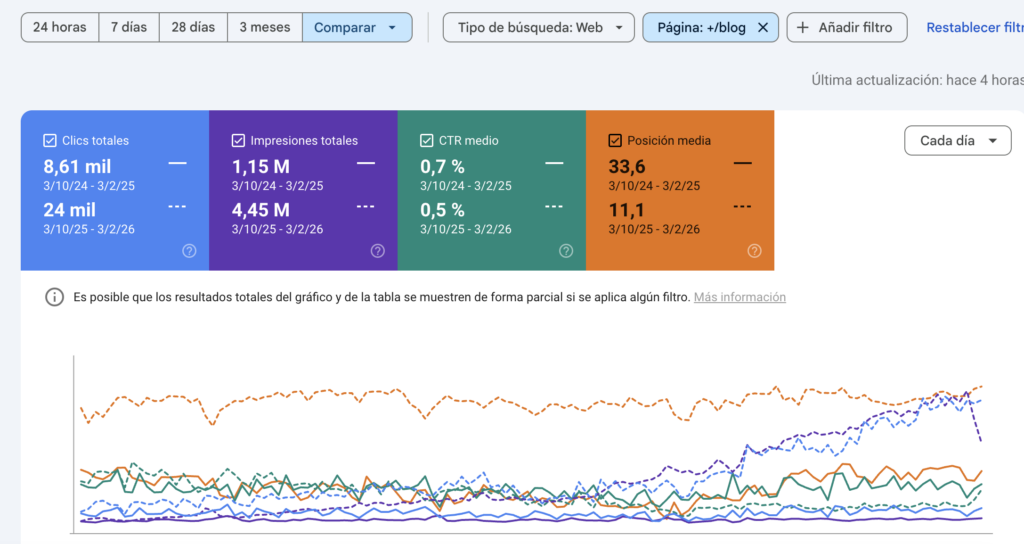

Periods analysed:

Comparison of the last 5 months (03/10/2025 – 03/02/2026) versus the same period in the previous year (YoY) (03/10/2024 – 03/02/2025).

Growth and performance milestones

- +182% growth in total traffic: increasing from 3,789 clicks to 10,698 total clicks, driven mainly by a mobile-first strategy that captured 7,610 clicks on mobile (vs 2,707 the previous year).

- Dominance in emerging brands core to the business: capturing demand for BYD, XPENG and CHANGAN. Specific articles such as the BYD Yangwang U9 pieces generated 3,128 organic clicks and 185,038 impressions over the last six months.

- Visibility surge: total impressions jumped from 889,928 to 2,292,931, multiplying brand exposure by 2.5x year-on-year.

- Key metrics (comparison): Content creation and technical optimisation transformed Sandicliffe’s acquisition architecture. Comparing the current period with YoY shows significant traffic generation and a substantial improvement in average ranking position.

KPI table: clicks, impressions, mobile and “Used Cars”

| Metric | Last 5 months (current) | YoY (Previous year) | Change |

| Total clicks | 10,698 | 3,789 | +182% (exponential growth) |

| Total impressions | 2,292,931 | 889,928 | 2.5x |

| Mobile clicks | 7,610 | 2,707 | +181% |

| «Used Cars» impressions | 12,498 | 386 | 32x |

Growth strategy

The plan was built on an aggressive, data-driven Content Marketing strategy, prioritising trending keywords, seasonal opportunities, and becoming recognised experts in them. We executed the production of 200+ new pieces of content alongside the optimisation of key assets, existing content that wasn’t yet ranking in top positions.

The ultimate goal was to cover the entire buyer lifecycle and position Sandicliffe as a topical authority on commercially relevant themes (BYD, Changan, XPENG, etc.).

1.1 Leadership in strategic areas and conquering new niches

The strategy focused on identifying content gaps and attacking market trends ahead of the competition.

The rise of emerging brands (BYD, XPENG, CHANGAN)

The decision to rank for disruptive Asian brands ahead of competitors resulted in a decisive win. Content Marketing became the undeniable growth engine: over 75% of total traffic in the period (approx. 8,200 clicks) came from new URLs published this year.

- BYD: virality + local transactional activation: This brand became the main driver of new traffic. The two BYD Yangwang U9 articles generated 3,128 organic clicks and 185,038 impressions in total. At the same time, transactional demand was activated: “byd leicester” grew from 0 to 763 clicks with a 16.5% CTR (4,613 impressions).

- XPENG: hyperlocal dominance in critical searches: We achieved immediate rankings for high-intent queries. “xpeng nottingham” reached absolute position 1 with a 28% CTR.

- CHANGAN: opening a market from scratch: Sandicliffe created demand in a previously non-existent market, managing to rank models such as “changan deepal s05” (39 clicks) in an emerging niche.

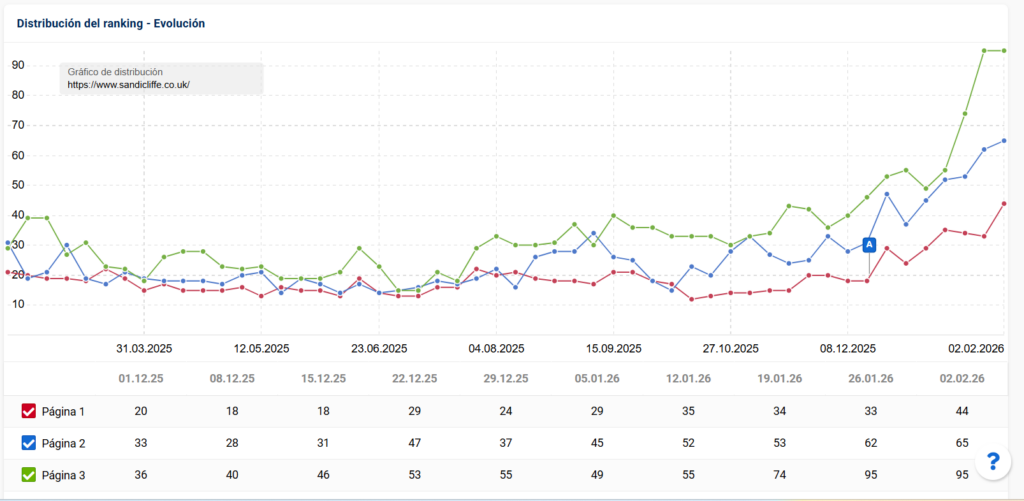

1.2 Consolidating rankings: from page 2 to Top 3

Beyond creating new content, we identified “latent demand” in keywords stuck on page 2 or low positions on page 1. Through technical and relevance optimisation, we positioned 413 keywords on page 1, pushing strategic terms into conversion zones:

- Ford Escape UK: from an average position of 9.4 (nearly invisible) to 3.5 (Top 3).

1.3 Dominance in informational queries (Top of Funnel)

Beyond vehicle models, the strategy captured audiences in early research stages. The new article “How to find out who owns a car” became a key digital asset, going from 0 to 1,052 clicks, validating that practical “how-to” content can be a major acquisition driver.

2. Business validation: hyperlocal demand

The most important win wasn’t just informational visibility, it was the activation of hyperlocal demand that connects online search with physical dealership visits.

High-intent local queries (CTR) by brand

- BYD: local queries such as “sandicliffe byd leicester” reached a 19.95% CTR, indicating very high visit intent.

- XPENG: the query “sandicliffe xpeng” achieved a 40.91% CTR, confirming brand recognition as the official distributor.

- Ford: local listing optimisation boosted queries such as “sandicliffe ford leicester used cars” (72 clicks, 29% CTR) and “sandicliffe ford nottingham used cars” (76 clicks, 11% CTR).

3. Bottom-funnel acceleration: 32x growth in used-car demand

The end goal was lead generation. The strategy reinforced pages with direct purchase intent.

3.1 Transactional searches: “used cars” visibility up 32x

3.1 Transactional searches: “used cars” visibility up 32x

Visibility for the generic pillar keyword “used cars” grew dramatically, from 386 impressions to 12,498 impressions (32x).

Reactivated models: click recovery and ranking improvements

- Ford Kuga: grew by 31% in clicks, improving average position to 3.65 (from 6.71) now a Top 5 query.

- Toyota Yaris Cross: grew by 28% in clicks, entering at an average position of 2.81 already Top 3.

3.2 Converting URLs: core listings + strengthened local pages

3.2 Converting URLs: core listings + strengthened local pages

The main listing page /cars/used-cars/ remained the top organic traffic URL (16,517 impressions), supported by strengthened location pages such as /our-locations/leicester-fordstore.html, which captured 653 direct clicks.

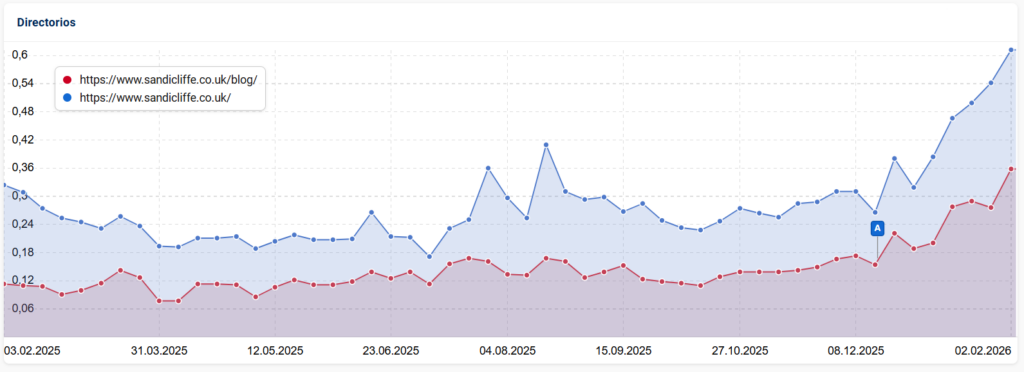

4. Blog-E-commerce synergy: the “engine effect”

Domain visibility analysis confirms the content strategy acted as a catalyst for Sandicliffe’s entire digital ecosystem. As shown in the time evolution chart (Feb 2025 – Feb 2026), there is clear symbiosis between blog growth and e-commerce performance.

- Topical authority transfer: By positioning the blog as a reference for “emerging brands” and “technical guides”, Google reassessed the authority of the entire domain. This allowed transactional pages (car sales) to rank better for competitive commercial keywords without the need for additional external links.

- The inflection point (Q4 2025): The chart shows how the late-year spike in blog activity (marked around milestone “A”) broke the main site’s plateau, pushing it to record-high visibility by February 2026.

- Informational content doesn’t just attract readers, it lifts the entire domain, confirming that a strong blog is the best engine for a high-performing e-commerce business.

Conclusion

Sandicliffe’s content expansion strategy delivered a full digital transformation in just five months. Moving from stable visibility to generating 10,000+ clicks and more than doubling total impressions, the brand proved that a data-led approach is the most efficient growth engine.

Sandicliffe didn’t just gain traffic, it secured future relevance, positioning itself as the clear local authority in the Midlands for both the traditional used-car market and the new wave of Asian electric automotive brands.

SANDICLIFFE TESTIMONIAL PROPOSAL:

“Our content strategy no longer just brings traffic, it now sells cars. We’ve turned the blog into one of our strongest sales engines.” – Elliot Stephenson, Marketing manager.

We help you boost your content strategy results

If you also want to get results with your content, start trying Keytrends in its free version or, even better, let’s see together how it can help you in your strategy in a 30 minutes demo.